Overview #

Candlestick charts are primarily used in trading, such as for stocks or commodities.

They are designed to convey a few pieces of financial information in a very compact form:

- Opening price

- Closing price

- High price

- Low price

A candlestick chart is made of a larger section called the real body, and two lines called wicks on either of the top and bottom of the real body.

The top end and the low end of the real body represents the opening and closing price.

The real body may be colored or shaded, depending on whether the close price is lower or higher than open price.

The tip of the upper wick represents the high price, and the tip of the lower wick represents the low price.

If the close price is higher than the open price, then the value went up and is generally considered a good thing.

(Traders in a short position might disagree).

Data #

For a candlesetick chart, the data must include:

- Opening price

- Closing price

- High price

- Low price

If a series of candlestick charts are desired, then there needs to be some sort of time dimension as well, such as date.

R:quantmod #

A candlestick chart can be plotted in R using the quantmod package.

# install.packages("quantmod")

library(quantmod)

The quantmod package includes a getSymbols function that can be used to retrieve data for a publicly traded company.

I could use this to grab information for my employer, Rapid7, which is publicly traded under the RPD symbol.

getSymbols("RPD", from = "2022-01-01", to = "2022-02-01", src = "yahoo")

## [1] "RPD"

This creates a data object named the symbol that was provided.

RPD

## RPD.Open RPD.High RPD.Low RPD.Close RPD.Volume RPD.Adjusted

## 2022-01-03 117.86 117.950 113.320 117.75 280500 117.75

## 2022-01-04 117.53 118.420 110.500 113.89 535600 113.89

## 2022-01-05 113.16 114.125 107.230 108.24 477400 108.24

## 2022-01-06 105.52 107.860 104.150 104.78 777100 104.78

## 2022-01-07 104.49 105.250 99.760 100.70 826200 100.70

## 2022-01-10 98.22 102.970 96.350 102.79 653800 102.79

## 2022-01-11 102.79 106.680 101.580 106.46 667200 106.46

## 2022-01-12 107.66 109.130 101.340 101.84 489700 101.84

## 2022-01-13 101.79 101.790 97.350 97.56 467000 97.56

## 2022-01-14 96.38 98.130 94.320 96.45 446400 96.45

## 2022-01-18 93.25 95.460 91.836 93.43 646400 93.43

## 2022-01-19 94.45 96.460 91.580 91.70 589700 91.70

## 2022-01-20 92.49 96.850 92.490 93.80 677000 93.80

## 2022-01-21 92.71 95.920 91.565 91.91 573600 91.91

## 2022-01-24 89.00 94.910 87.846 94.36 774300 94.36

## 2022-01-25 92.25 93.050 88.540 88.72 670600 88.72

## 2022-01-26 91.31 93.810 88.960 89.79 649800 89.79

## 2022-01-27 90.70 92.510 86.430 87.49 511200 87.49

## 2022-01-28 88.09 92.030 85.560 92.03 711800 92.03

## 2022-01-31 92.22 96.580 91.430 96.33 715700 96.33

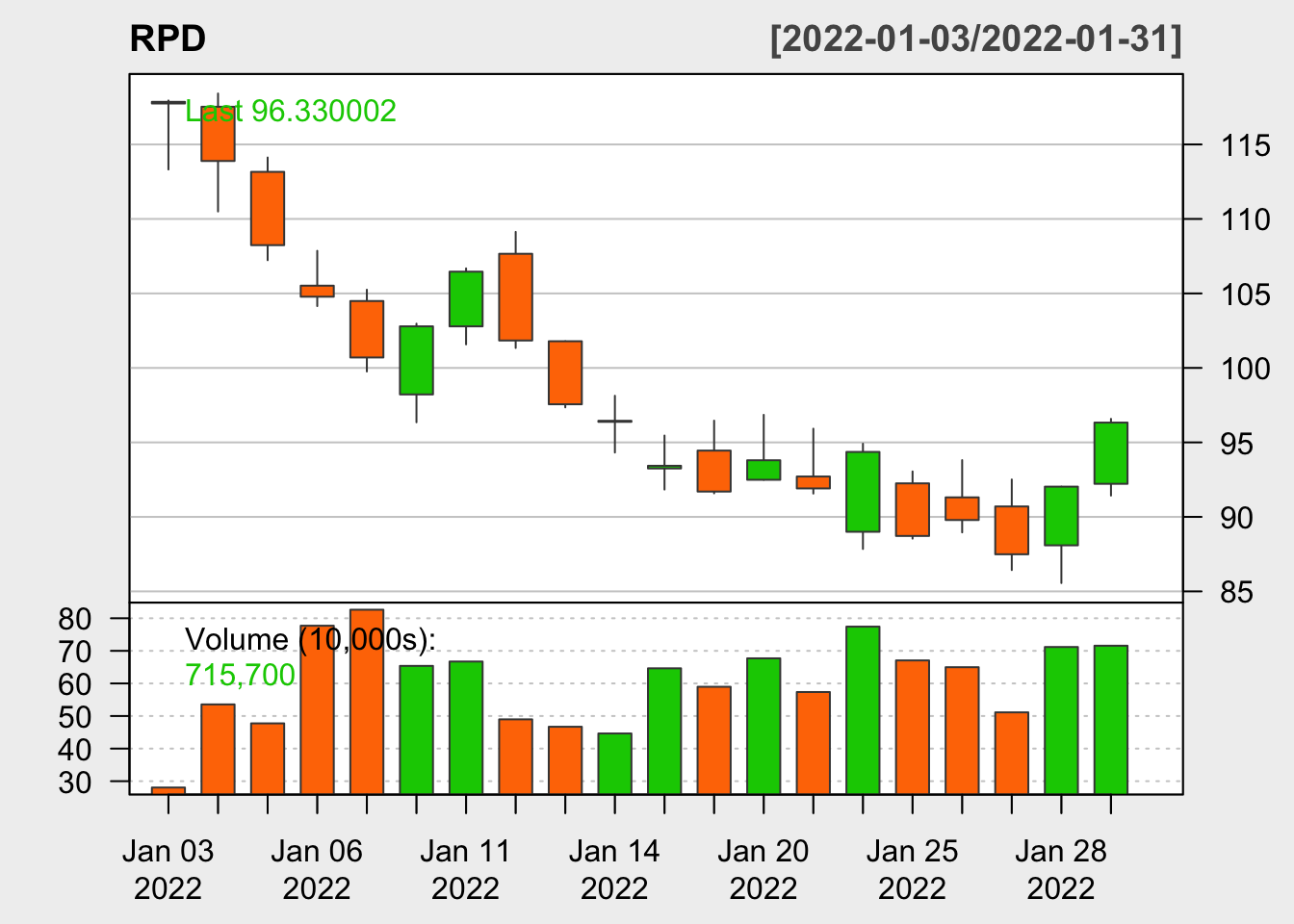

Now let’s plot the data. quantmod provides a simple chartSeries function to plot the data.

chartSeries(RPD)

The color of the plot can be changed.

chartSeries(

RPD,

theme = chartTheme("white")

)

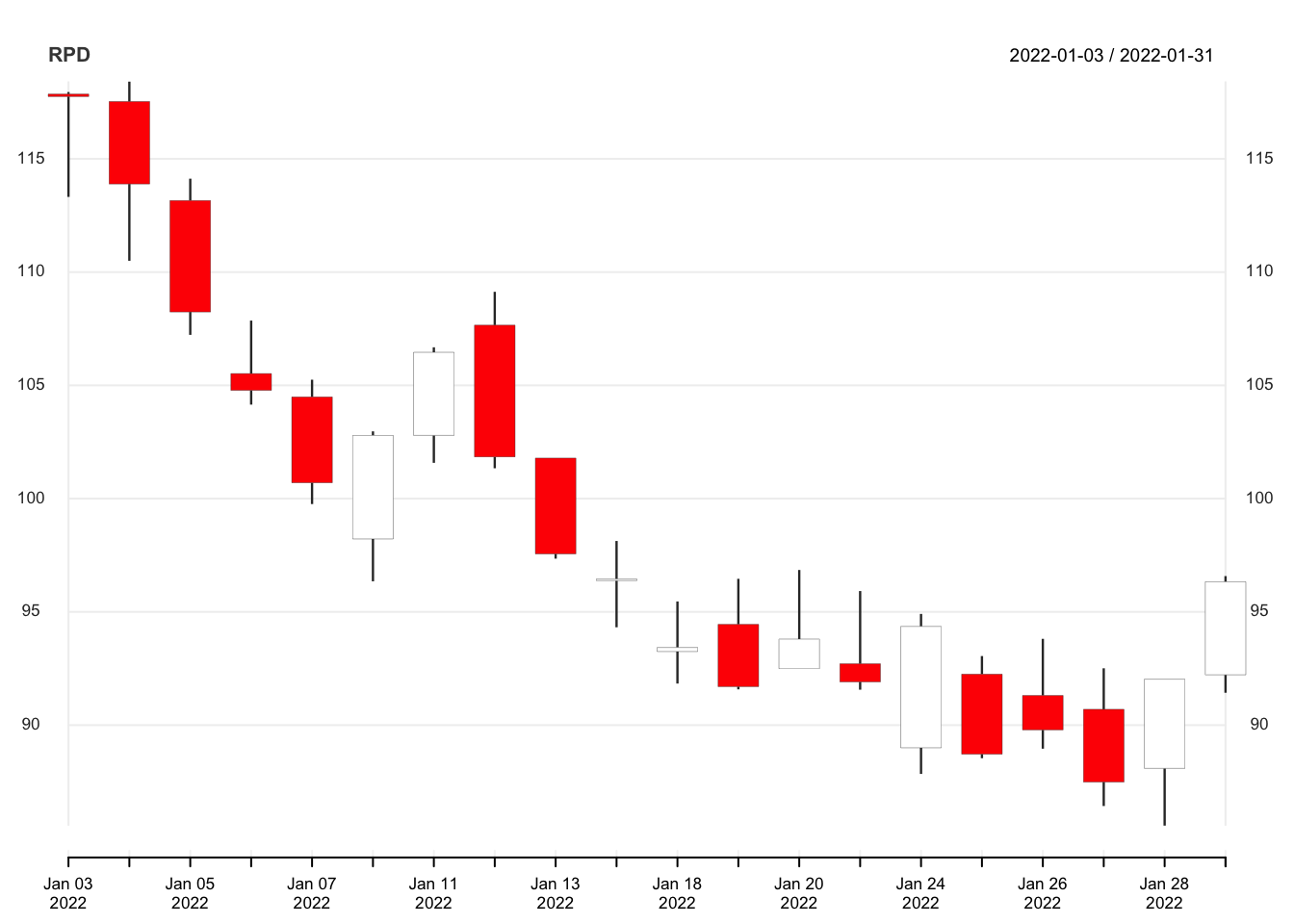

There’s also a slight plotting variant called chart_Series (note the underscore), which comes with a different default theme.

chart_Series(RPD)

This too can be customized with some parameters.

custom_theme <- chart_theme()

custom_theme$col$dn.col <- "orange"

custom_theme$col$up.col <- "green"

chart_Series(

RPD,

theme = custom_theme

)

R:tidyquant #

Another R package that can be used to put together candlestick charts is tidyquant, which builds upon quantmod and incorporates a bunch of features from the tidyverse and ggplot2.

# install.packages("tidyquant")

library(tidyquant)

The tq_get() function can be used to retrieve stock data.

rpd_stock <- tq_get("RPD", get = "stock.prices", from = "2022-01-01", to = "2022-02-01")

kable(rpd_stock)

| symbol | date | open | high | low | close | volume | adjusted |

|---|---|---|---|---|---|---|---|

| RPD | 2022-01-03 | 117.86 | 117.950 | 113.320 | 117.75 | 280500 | 117.75 |

| RPD | 2022-01-04 | 117.53 | 118.420 | 110.500 | 113.89 | 535600 | 113.89 |

| RPD | 2022-01-05 | 113.16 | 114.125 | 107.230 | 108.24 | 477400 | 108.24 |

| RPD | 2022-01-06 | 105.52 | 107.860 | 104.150 | 104.78 | 777100 | 104.78 |

| RPD | 2022-01-07 | 104.49 | 105.250 | 99.760 | 100.70 | 826200 | 100.70 |

| RPD | 2022-01-10 | 98.22 | 102.970 | 96.350 | 102.79 | 653800 | 102.79 |

| RPD | 2022-01-11 | 102.79 | 106.680 | 101.580 | 106.46 | 667200 | 106.46 |

| RPD | 2022-01-12 | 107.66 | 109.130 | 101.340 | 101.84 | 489700 | 101.84 |

| RPD | 2022-01-13 | 101.79 | 101.790 | 97.350 | 97.56 | 467000 | 97.56 |

| RPD | 2022-01-14 | 96.38 | 98.130 | 94.320 | 96.45 | 446400 | 96.45 |

| RPD | 2022-01-18 | 93.25 | 95.460 | 91.836 | 93.43 | 646400 | 93.43 |

| RPD | 2022-01-19 | 94.45 | 96.460 | 91.580 | 91.70 | 589700 | 91.70 |

| RPD | 2022-01-20 | 92.49 | 96.850 | 92.490 | 93.80 | 677000 | 93.80 |

| RPD | 2022-01-21 | 92.71 | 95.920 | 91.565 | 91.91 | 573600 | 91.91 |

| RPD | 2022-01-24 | 89.00 | 94.910 | 87.846 | 94.36 | 774300 | 94.36 |

| RPD | 2022-01-25 | 92.25 | 93.050 | 88.540 | 88.72 | 670600 | 88.72 |

| RPD | 2022-01-26 | 91.31 | 93.810 | 88.960 | 89.79 | 649800 | 89.79 |

| RPD | 2022-01-27 | 90.70 | 92.510 | 86.430 | 87.49 | 511200 | 87.49 |

| RPD | 2022-01-28 | 88.09 | 92.030 | 85.560 | 92.03 | 711800 | 92.03 |

| RPD | 2022-01-31 | 92.22 | 96.580 | 91.430 | 96.33 | 715700 | 96.33 |

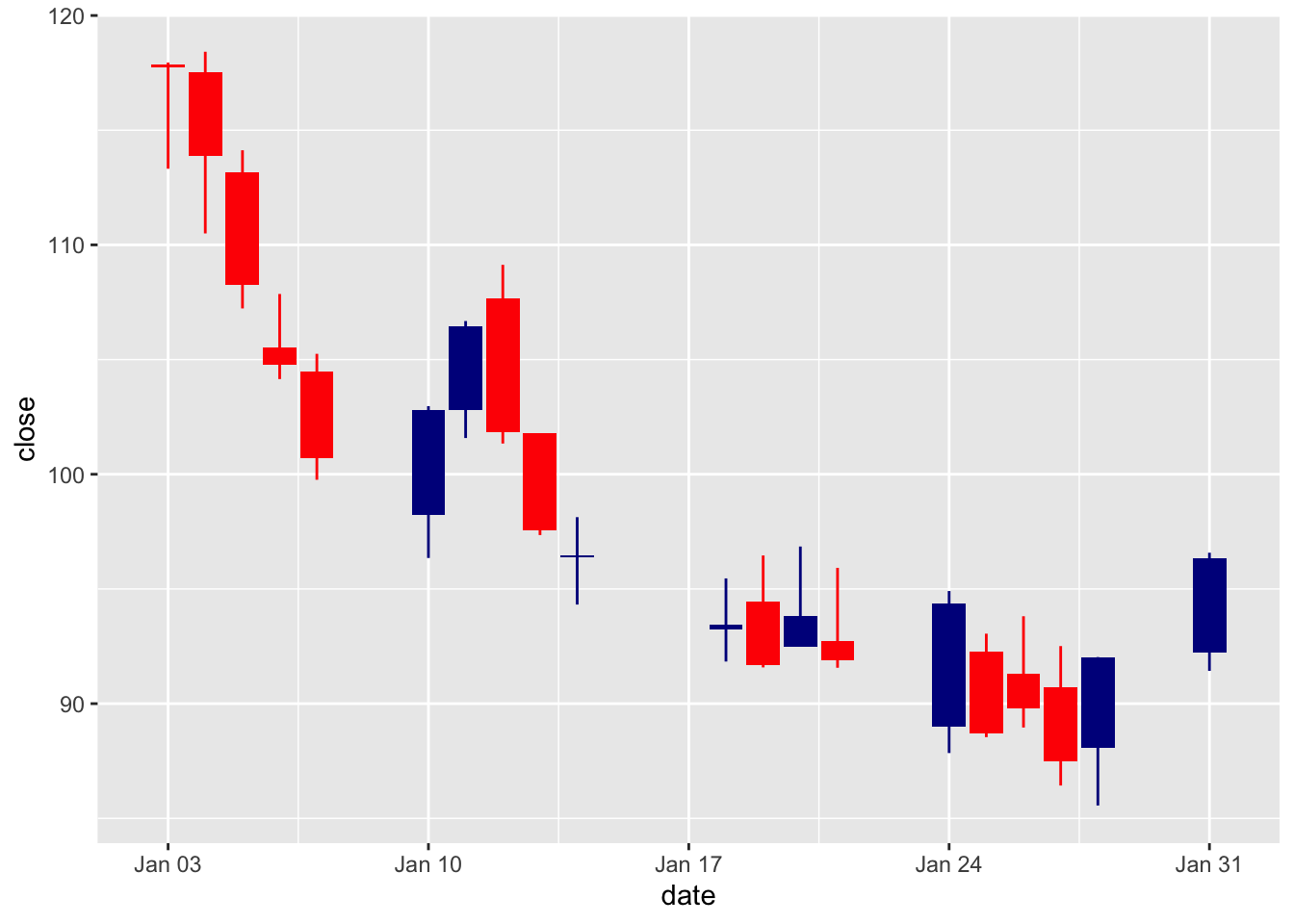

A candlestick chart can be prepared using the geom_candlestick() function.

rpd_stock %>%

ggplot(

aes(

x = date,

y = close

)

) +

geom_candlestick(

aes(

open = open,

high = high,

low = low,

close = close

)

)

## Warning: The following aesthetics were dropped during statistical transformation: open,

## high, low, close, y

## ℹ This can happen when ggplot fails to infer the correct grouping structure in

## the data.

## ℹ Did you forget to specify a `group` aesthetic or to convert a numerical

## variable into a factor?

## Warning: The following aesthetics were dropped during statistical transformation: x,

## open, high, low, close, y

## ℹ This can happen when ggplot fails to infer the correct grouping structure in

## the data.

## ℹ Did you forget to specify a `group` aesthetic or to convert a numerical

## variable into a factor?

## Warning: Using the `size` aesthetic in this geom was deprecated in ggplot2 3.4.0.

## ℹ Please use `linewidth` in the `default_aes` field and elsewhere instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

## generated.

Let’s dress it up some.

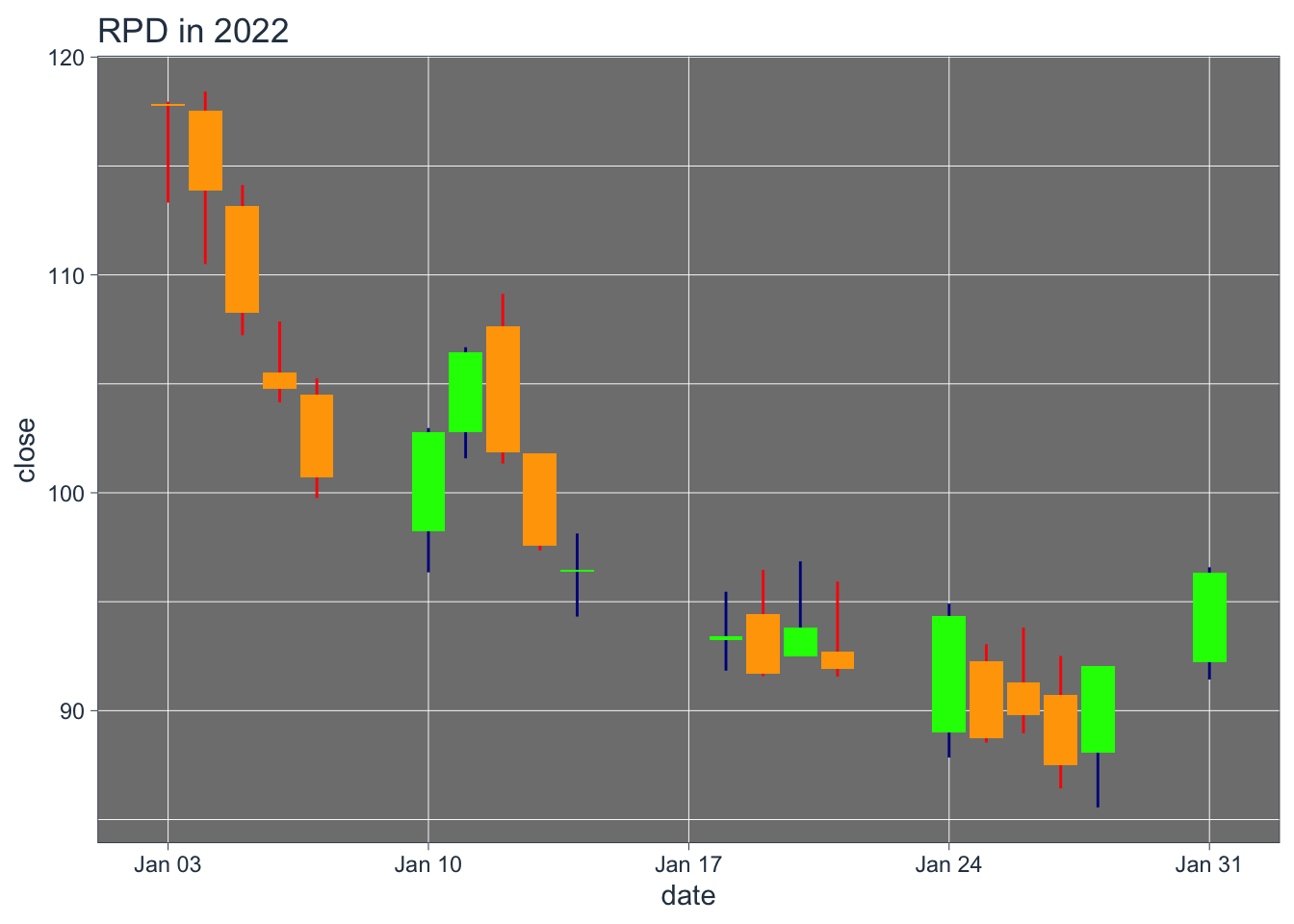

rpd_stock %>%

ggplot(

aes(

x = date,

y = close

)

) +

geom_candlestick(

aes(

open = open,

high = high,

low = low,

close = close

),

color_up = "green", fill_up = "green",

color_down = "orange", fill_down = "orange"

) +

theme_tq_dark() + # assign a new theme

labs(

title = "RPD in 2022"

)